WMCC payment plans are convenient, secure, and affordable!

Your school partners with Nelnet Campus Commerce to let you pay your tuition and fees over time, making college more affordable. Payment plans are not loan programs and are interest free. Instead, payments are automatic – set them and forget them.

Enrollment Benefits

- Enroll in a payment plan so you can pay your balance in installments

- For students without financial resources to pay in full or enough Financial Aid to cover all your tuition and fees

- To find out what payment plans are available or sign up for a plan, click here

- Fall and Spring semester plans will automatically adjust (+/-) to reflect most recent account balance

- Interest free payments drawn from your credit/debit card (2.85% fee will be accessed) or checking/savings account

Eligibility Requirements

- Must have your Easy Login user ID and password to sign into Student Information System (SIS)

- Must have a U.S. checking account, savings account, or valid credit/debit card

- Must pay a $35 nonrefundable enrollment fee per semester charged by Nelnet Business Solutions (NBS)

Payment Methods

- Automatic bank payment (ACH)

- Credit/debit card payment (2.85% fee will be assessed)

Cost to Participate

- $35 per semester nonrefundable enrollment fee

- $30 returned payment fee if payment is returned

Simple steps to enroll

- Login to WMCC Student Portal

- Click on SIS

- Click on Student

- Click on Student Account

- Click on View and Pay Account

- Click on Set up a Payment Plan

- Only Fall and Spring semester plans will automatically adjust (+/-) to reflect most recent account balance

Summer 2024

Payment Plan Schedule

Summer 2024 Payment Plan available on March 18, 2024

Last Day to Enroll Online | Required Down Payment | Number of Payments | Months of Payments | Payment Date |

| April 4 | None | 4 | April-July | 5th |

| April 25 | 25% | 3 | May-July | 5th |

| May 24 | 33% | 2 | June & July | 5th |

| June 25 | 33% | 2 | July & August | 5th |

Fall 2024

Payment Plan Schedule

Fall 2024 Payment Plan available on March 18, 2024

Last Day to Enroll Online | Required Down Payment | Number of Payments | Months of Payments | Payment Date |

| June 3 | none | 6 | June – Nov | 5th |

| July 2 | none | 5 | July – Nov | 5th |

| July 25 | 20% | 4 | Aug – Nov | 5th |

| Aug 26 | 25% | 3 | Sept – Nov | 5th |

| Sept 26 | 33% | 2 | Oct & Nov | 5th |

Spring 2025

Payment Plan Schedule

Spring 2025 Payment Plan available on November 18, 2024

Last Day to Enroll Online | Required Down Payment | Number of Payments | Months of Payments | Payment Dates |

| Dec 3 | none | 5 | Dec – April | 5th |

| Dec 24 | 20% | 4 | Jan – April | 5th |

| Jan 27 | 25% | 3 | Feb – April | 5th |

| Feb 24 | 33% | 2 | March & April | 5th |

NOTE: All down payments are processed immediately!

Please Note: The above “Last Day to Enroll Online” dates are not the payment due dates for the college.

Nelnet Campus Commerce is available Monday-Friday 7:00 AM to 9:00 PM CST and Saturday 8:00 AM to 2:00 PM CST at 800-609-8056.

Third Party Authorization

- Military/Veteran students must turn in DD214, COE (Certificate of Eligibility), 2171, or other approved document of benefits

- Government or State Agency funding must be in writing such as purchase order or letter documenting summary of benefits

- Please note: Tuition reimbursement to you by your employer is not a guaranteed form of payment. In this case, you are required to pay for the course up front, and upon completion submit a request for your employer to reimburse you for the course.

Refunds

To Sign Up for Electronic Refunds

- Login to WMCC Student Portal

- Click on SIS

- Click on Student

- Click on Student Account

- Click View and Pay Account

- Click on Manage Refund

First-Time Users

- Choose a refund method (Bank Account Direct Deposit or Reloadable Debit Card)

- Follow the prompts to enter your bank account/reloadable debit card information

Students who are enrolled and wish to edit their refund method

- Click on Edit Refund Method

- If you are due a refund, the refund will be processed by the method you have selected. NBS will notify you by your student email account as to the progress of your refund.

Please Note:

- Electronic refunds are processed within 2-3 business days from the time of email notification

- Paper checks are mailed out and usually expected to arrive within 7-10 business days from the time of email notification

- Student accounts are evaluated, and refunds are processed on a regular basis

Financial Aid Refunds

The College is federally mandated to process refunds within 14 days of disbursement of all Title IV Federal Financial Aid funds.

Credit balances from credit or debit card payments will be refunded back to the original payment card within six months of the payment. Otherwise, a refund will be processed to you via the method you have specified. If you have not selected direct deposit, a check will be generated and mailed to your address on file in the WMCC Student Information System database.

Refunds from scholarships will be processed when requested by the student in writing or by email to Jessica Hill. Note: Scholarship refunds will only be processed from refundable scholarships, which is usually noted on the original scholarship letter.

Important

- Single semester loans will have two disbursements; please plan accordingly

- Some financial aid programs may not be disbursed until well into the semester, especially for first-time students; please plan accordingly

- Credit balances from financial aid cannot be held from one academic year to another; therefore, alloutstanding financial aid credit balances will be refunded to the student

- Regardless of who remitted the payment to the student account, the refund will be made payable to the student, except for credit balances produced by a Parent Plus Loan and certain scholarships/trusts

- Parents have the election to have any excess funds refunded to the student, however, would have to choose that election during the financial aid process

- Some types of financial aid can only be used to pay for certain types of charges; therefore, you could receive a refund even if you have outstanding charges on your account from the current or previous terms

- You are responsible for paying the balance on your account, if one remains, even after you receive a financial aid refund

- A student who has received a refund based on financial and later changes enrollment status may be required to repay all or part of the aid received to the college or to the appropriate federal or state financial aid programs

- Students receiving federal aid, other than Federal Work-Study funds, who withdraw, change enrollment status (increase or decrease credit hours), or are reported for non-attendance, will have federal financial aid adjusted in accordance with formulas prescribed by the Federal Title IV Program

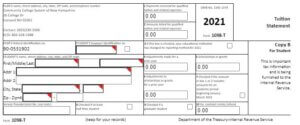

1098T TAX INFORMATION

Depending on your income (or your family’s income, if you are a dependent), whether you were considered full or half-time enrolled, and the amount of your qualified educational expenses for the year, you may be eligible for a federal education tax credit. You can find detailed information about claiming education tax credits here.

The dollar amounts reported on your Form 1098-T may assist you in completing IRS Form 8863 – the form used for calculating the education tax credits that a taxpayer may claim as part of their tax return.

White Mountains Community College is unable to provide you with individual tax advice, but should you have questions, you should seek the counsel of an informed tax preparer or adviser.

Below is a blank sample of the 2021 Form 1098-T that you will receive in January 2023 for your general reference.

ACCESSING YOUR 1098-T

Login to your account through the WMCC Student Portal.

- Click on the Student Button

- Click on Student Account

- Click on Tax Information

- Enter Tax Year

- Print your 1098T